The PSC contract and terms

Fiscal terms

Competitive and Transparent Fiscal Terms

The Dominican Republic offers an attractive investment environment, underpinned by strong and sustained economic growth. Upstream investment in the country will benefit the Dominican Republic with greater development, technical knowhow, new business for local firms and create more, better paying jobs. Diversification of the economy will help to protect the economic viability of other important sectors, such as industry and tourism, and create a sustainable cycle of economic activity.

The fiscal terms are progressive, encouraging the development of marginal projects but capturing a greater “State Share” in projects of greater profitability. The Dominican system is in the 1st quartile in terms of competitiveness globally in all basins, sizes of discoveries and at different prices.

The fiscal regime allows the State to capture its income through four mechanisms: Shared income; Income tax; Area rent and minimum state participation tax.

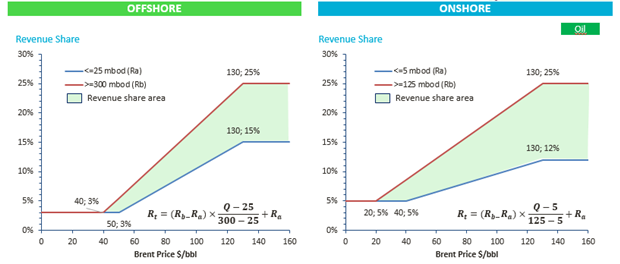

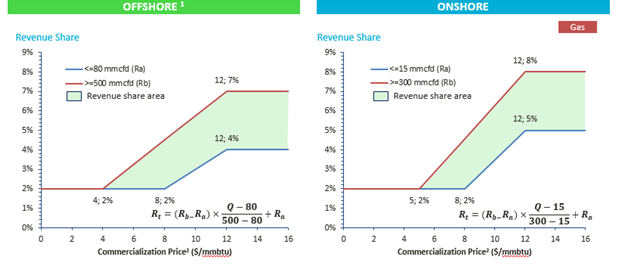

Revenue Share

Revenue Share depends on 2 variables, hydrocarbons production and commodity price and varies depending on the fields shore as follows:

Additional notes:

- Offshore includes shallow and deep water

- Commercialization prices for gas are determined by the parity import price for LNG in the Dominican Republic.

- Price is not adjusted by inflation

Area Rentals

Area rentals onshore:

- 1st exploration period: US$25/km2

- 2nd and 3rd exploration periods: (including evaluation period) US$50/km2

- Exploitation period: US$500/km2

Area rentals offshore:

- 1st exploration period: US$100km2

- 2nd and 3rd : exploration periods (including evaluation period) US$150/km2

- Exploitation period: US$1000/km2

Minimum state participation

TheThere is a Minimum State Participation Tax that limits the lower end of the State Share to be no less than 40% of cumulative undiscounted profits. If the State gets less than 40% of cumulative profits, the MSPT is applied to cover the difference.

The calculation will be made annually based on the financial statements of the previous year.

Minimum State Participation Tax (MSPT)=0.4 × CP-CSP

The PSC contract

The contracts have built-in provisions that enhance DR’s competitive fiscal policies.

Flexible contract phases

Exploration

- Onshore: 8 years total (Initial

period 3 yrs; second 3 yrs; third 2 yrs) - Offshore: 10 years total (Initial

period 4 yrs; second 3 yrs; third 3 yrs)- Possibility of 1-year extension per period (MEM

authorization)

- Possibility of 1-year extension per period (MEM

Evaluation

- Onshore: 2 years; Offshore: 3 years

- Non-associated gas – 10 years

- Possibility of extension of 2 years (MEM authorization)

Possibility of extension of 2 years (MEM authorization)

Relinquishment

- > 25% of orig. exploration area returned at end

of first exploration period- Excludes areas designated as evaluation and

exploitation - >34% of remaining area at end of second

exploration period

- Excludes areas designated as evaluation and

Company guarantees

The round will require guarantees from operators at different stages

| Purpose | Duration | Value | |

| Corporate guarantee | Guarantee from parent company to fulfill contractual obligations in the DR | Contract duration | No specific value |

| Offer guarantee | Ensures the seriousness of the bid during the round | Valid during the bid process and until blocks are awarded | US$100,000 |

| Exploration period guarantee | Ensures companies will fulfill their work commitments during the exploration round | Valid during the exploration period | 100% of minimum work commitment and 20% of additional work commitment |

Simple environmental requirements

The environment licensing process promotes responsible execution of E&P activities

- Operators must follow the well defined process to get environmental licenses for E&P activities

- The process involves the participation of the Ministry of Energy and Mines (MEM)

- Final approvals will be granted by the Ministry of Environment and Natural Resources

- Periods of delay caused by approval/permit process will be added to contract phase

Expedited dispute resolution period

- Contract provision ensures disputes involving foreign investors are resolved within two months

Stability clause in contracts

- Contractual terms and fiscal terms stable during the contract duration

- Contract approved by the congress, making it law

- The contract establishes a LEGAL STABILITY CLAUSE protecting the interests of the parties

Low Risk for Investors

In order to facilitate investment, the Dominican Republic has worked with their partners to deliver terms to Investors that are highly competitive, progressive and simple. The process will be entirely transparent, with flexible terms based on international best practices.

There is no signing bonus, and Contractual terms and fiscal terms will remain stable during the contract duration. The contract will be approved by congress and will become a law. Interested companies will be able to nominate blocks.

Abandonment Fund

Investors will be required to contribute to an abandonment fund, designed to guarantee the necessary resources for the activities relating to abandonment of a field. These funds will be sent to an escrow account, and the entire fund must be covered two years before the project ends

Prequalification and awarding criteria

Prequalification Criteria

Companies that comply with the financial, technical, and HSE criteria will be authorized to participate in the bidding process. Companies belonging to the “Energy Intelligence Top 100” will be exempt from all the requirements.

Regarding Financial Criteria:

- Companies

must provide 20F, 10K, annual reports or equivalent, or financial statements

audited by certified or registered companies to perform such activities in

accordance with the laws of the country of origin

Regarding Financial Criteria:

- Companies

must provide 20F, 10K, annual reports or equivalent, or financial statements

audited by certified or registered companies to perform such activities in

accordance with the laws of the country of origin

Regarding Technical Criteria:

- Operators

that meet the prequalification criteria for deepwater fields are considered

qualified for shallow and onshore water fields; and those qualified for shallow

water are considered qualified for onshore fields - Operators

will have to meet the requirements of exploration wells or minimum production

wells - The

minimum participation for operators in a consortium is 30%

Award Criteria

The awarding criteria is simple and transparent, focused on incentivizing exploration. Blocks will be assigned solely on additional work commitments – in simple terms, the company willing to execute the most exploration will win the block. Each block will have a minimum commitment of work, measured in “work units” (WU). Operators will offer additional work units, and the tie-off criteria will also be in work units. The Minimum Work Commitment is as follows:

- 1 WU =

USD $5,000 - Minimum

work commitment for onshore is 400 WU (USD $2 million) - Minimum

work commitment for offshore is 800 WU (USD $4 million)

The work commitments per exploration period are as follows:

- First

Period: minimum commitment + additional offer - Second

Period: 2 x minimum commitment

Third Period: 1 exploratory well